Research, Strategy & Experience Design to Optimize Messaging for Collections Customers

This UX case study centers on a fintech martech startup serving financial and fintech clients as a first-party provider, where we designed customer communications for collections—one of the most regulated and trust-sensitive moments in the user journey. The work required coloring inside the lines: treating compliance requirements as design constraints while still creating clear, empathetic, and usable experiences.

By applying human-centered UX principles within strict regulatory frameworks, we aligned legal, compliance, and brand stakeholders to deliver compliant messaging that reduced customer friction, improved clarity, and supported better repayment outcomes—proving that when the rules are clear, there’s more room to design experiences that actually work.

PROBLEM

Customers reported confusion, disengagement, and frustration with current messaging efforts, leading to low response rates and poor repayment follow-through.

As a Head of Experience Strategy & Creative Operations, I led my team in the following:

Creative Strategy

Design & Development

In-Market Optimization

PROCESS

A structured, cross-functional process balanced compliance with clarity and empathy, and ensured a human-centric result

This approach included:

-

Auditing all existing communications and gathering customer insights

-

Defining audience segments and mapping customer journeys

-

Creating a clear messaging framework and tone guidelines

-

Designing consistent multi-channel templates with improved UX

-

Partnering early with legal to streamline compliance

-

Testing and iterating with real customer feedback

-

Phasing rollout with monitoring and feedback loops

USERS & AUDIENCE

Existing data and mixed-methods research unveiled 3 critical findings

As a niche service provider we specialized in this target audience and already had existing mixed-method research. This method was chosen to achieve a more balanced view of user experiences and preferences.

Customers were often behind on multiple financial obligations

Under stress, with varying levels of financial literacy

Needed clear, empathetic guidance to take the next step without feeling shamed or threatened

INITIAL ASSESSMENT

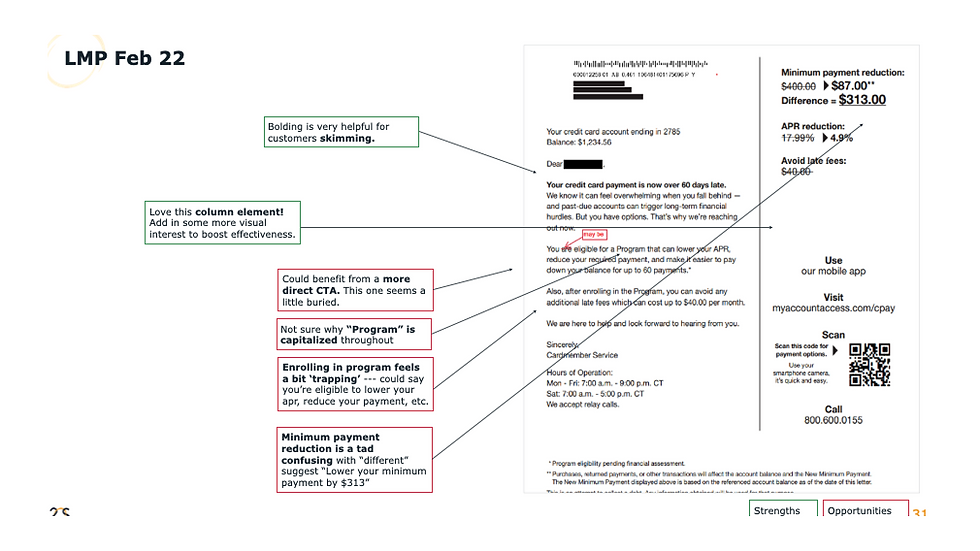

Too much legal jargon & lack of personalization led to customer confusion and low engagement

The fintech’s existing communication was outdated in design and relied heavily on legal language, making it intimidating and difficult to understand.

MESSAGING STRATEGY

This end-to-end messaging strategy gave fintech customers the human-centric experience they desired

The recoveries messaging framework delivered:

-

Clear structure: messages organized around “what happened, what it means, what to do next.”

-

Plain language: replacing jargon with straightforward explanations.

-

Empathetic tone: acknowledging customer stress while reinforcing options for resolution.

-

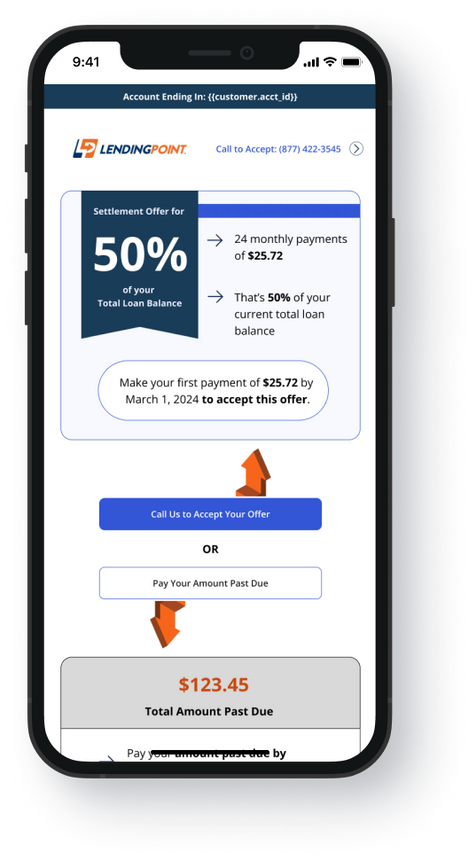

Multi-channel delivery: email, SMS, and in-app notifications aligned for consistency.

-

Compliance alignment: every message co-created with legal for approval, but simplified for customer readability.

CREATIVE DEVELOPMENT

This messaging strategy was paired with the clients' brand guidelines and integrated with my customized design system

Each message was designed with audience segmentation, personalization, and automation in mind.

FINAL PRODUCT

Once finalized with my cross-collaborative feedback loop, new messages were put into market

Once in market we conducted ongoing performance analysis and iteration via A/B testing methodology

Review in-market data

Brainstorm & ideate solutions

Finalize and launch

OUTCOMES

The results speak for themselves

+70%

Increase in Email Open Rates

+300%

Increase in Click Through Rates

-40%

Reduction in call center escalations

$13M+

Higher repayment success rates

Collaborate Early

Compliance, marketing and clarity can coexist: Partnering early with legal reduced friction and produced better outcomes

Lead with Empathy, Earn Response

Empathy drives engagement: Customers were more responsive when language acknowledged their situation

Aligned Messaging, Reduced Confusion

Consistency matters: Aligned messaging across email, SMS, and app reduced confusion

Test & Learn

Iterate with real feedback: Small-scale tests validated tone and helped refine phrasing before rollout